How to build bitcoin apps and payment apps in 2020

-

3635

-

1

-

9

-

0

While the COVID-19 outbreak caused a major economic recession in multiple countries due to lockdown, cryptocurrencies are stable or growing. With the Bitcoin mining reward being halved from 12.5 BTC to 6.25 BTC per block in May of 2020, the cryptocurrency market globally prepares for a bull run afterward. The previous 2 reward halvings resulted in major influx of new users, and there is no reason to think 2020 will be any different in that regard.

Besides, as many countries are lifting the bans for cryptocurrency usage (like in India) and are looking toward developing state-supported cryptocurrencies issued by central banks (like the US, China, Russia, Japan, Sweden and Ukraine) — the worldwide acception of blockchain as the future of no-cash money is more likely than ever. In addition, as millions of people have to refrain from dealing in cash while staying locked down, the demand for secure and highly-performing payment apps for shopping online has skyrocketed.

The top 5 cryptocurrencies that expect heavy demand in 2020 are Bitcoin (BTC), Ethereum (ETH), Dash (DASH), Ripple (XRP), Tron (TRX). Bitcoin is the leading cryptocurrency worldwide, Ethereum serves as the means of payment for multiple smart contracts in blockchain apps booming around the globe, Dash is the best cryptocurrency for instant payments, Ripple provides an infrastructure allowing a consortium of 100+ banks in Japan, Hong-Kong and Singapore to enable rapid banking transactions, and Tron currently owns BitTorrent, the largest legal collection of torrent files worldwide and Steemit — a social media platform for cryptocurrency investors. Both projects have huge followings, which make Tron one of the most promising cryptocurrencies nowadays.

Thus said, the spring of 2020 is a great time to launch the development of financial apps, as people worldwide are getting used to using payment apps instead of cash transactions, and this trend will stay strong after the quarantine is lifted!

This article covers all you need to know about development of various financial apps, both bitcoin apps for cryptocurrency trading and instant payment apps for online shopping. Read on to learn the following:

- How to start developing your payment app or website (a roadmap)

- What specialists are needed for MVP development and how to find them quickly

- What project aspects must be done internally and what can be outsourced

- What cloud platform to select (checklist)

- How to ensure your app operates securely

- How to gain traction and promote your financial apps efficiently

How to start developing your payment app or website (a roadmap)

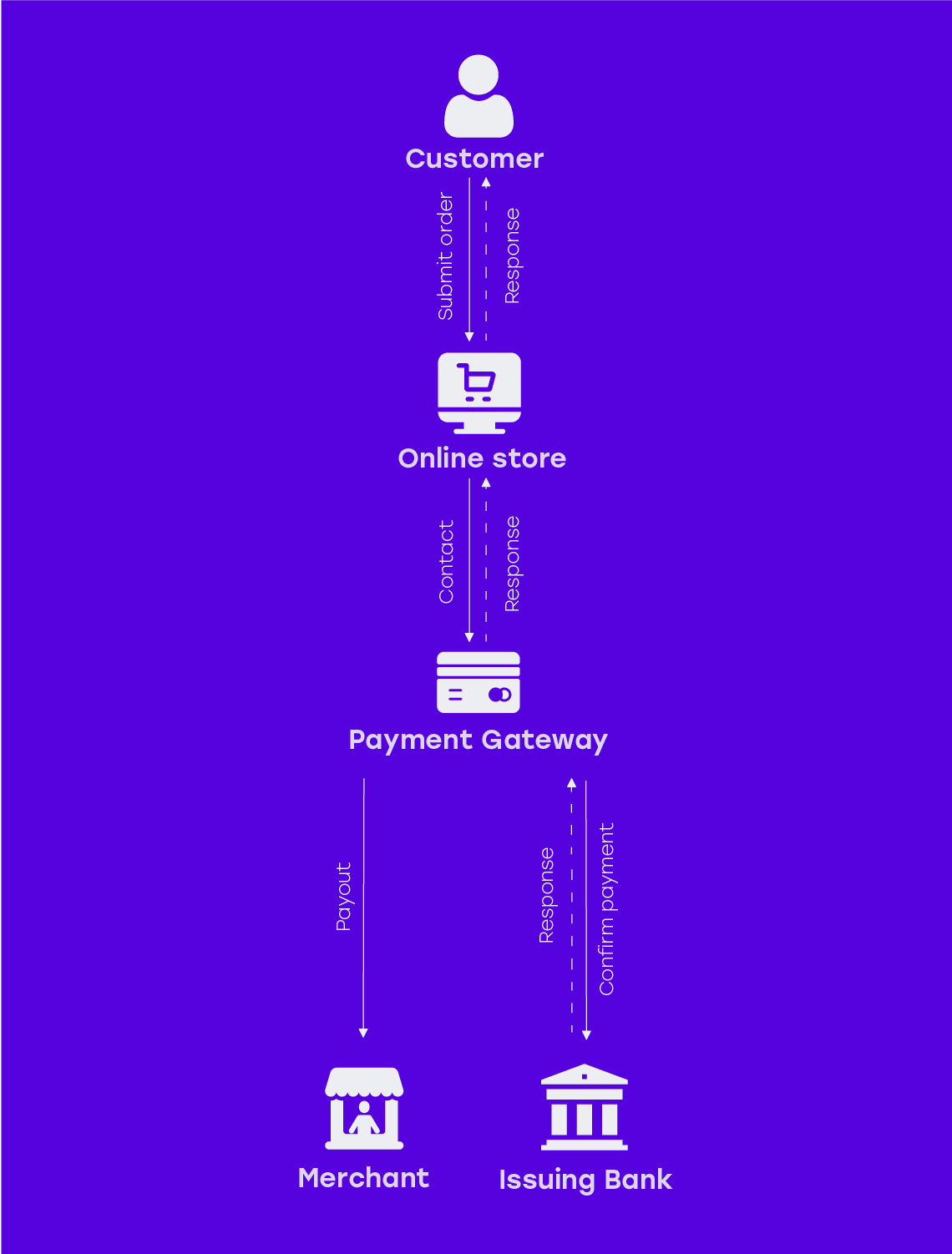

1. SELECT THE MERCHANT ACCOUNT TYPE AND THE PAYMENT GATEWAY. Payment gateways are technological solutions used to integrate bank card payments and other financial transactions on websites and in mobile applications.

There are several major payment gateways: Stripe, PayPal and Braintree, Visa Checkout, Dwolla, etc. Why would you need this extra layer of transactions? Because this provides an easy way of accumulating funds to enable simple refunds should your customers request it.

All payment gateways provide two types of merchant accounts: aggregate or dedicated. Aggregate accounts hold the funds of several merchants, they are quick to approve with the provider and cost less in terms of subscription fees.

Dedicated merchant accounts are a bit more pricey, they require a bit longer verification and KYC procedure — but you get an account exclusively for yourself. Every trader has to make such judgment calls themselves and the type of account can be changed later on, if your project succeeds.

Thus said, once you have decided what type of account to use, you should select what payment gateway to integrate with your financial app. It is wise to select as many of them as you can to enable the majority of your potential customers to pay the way they like it. However, it is also important to ensure security of handling customer’s banking details and personally-identifying information. Major payment gateways like Stripe or PayPal handle their security very seriously, so you would be safe to stick to them.

2. ENSURE PAYMENT CARD INDUSTRY COMPLIANCE. There is a set of rules and standards known as PCI-DSS that regulates how you should handle the data security in your payment processing operations. Make sure the payment apps you develop comply with these regulations from the start, or they will never be registered and approved for usage.

3. SELECT THE BASIC FEATURES TO INCLUDE IN YOUR APP. People might forgive slight clunkiness or lagginess of your MVP, but they will never use any payment apps they don’t feel to be secure. Thus, you should ensure the following features are present:

- Log in and unlock. Your app users should be able to create accounts using their email addresses/social media profiles and login/unlock them with security codes, fingerprint scans and other secure authentication methods.

- Integration with banks. The app must be able to add banking accounts for international and local banks via standardized APIs and SDKs, and the account information should be displayed in the app. .

- Fund transfers. The users of your financial apps must be able to transfer funds to other users via a banking account number, email, phone number, customer ID and a variety of other methods.

- Fund requests. Your users can request funds from other users via all the methods mentioned above.

- Referrals. Users might be able to refer your app to their friends and contacts and earn rewards for that.

- Payment efficiency. Your financial apps must enable swift and easy payments across the board using virtual cards within the app.

- Blockchain wallets. Your bitcoin apps must provide the same functionality and enable wallet transactions, ledger access and consensus participation.

You can add various other features depending on your team skills, product niche, time frames and a variety of other factors.

4. DESIGN A PROJECT ROADMAP. As soon as you know how much time and money you can invest and the features you want to include in the MVP, it’s time to prepare a project roadmap.

- Analyze the existing situation on the payment apps market.

- Take a close look at potential competitors.

- Make a list of core functions you want to include in your MVP

- Plan for some killer features to make your future product stand out

- Enlist a trustworthy software development expertise in-house or via IT outsourcing

- Write high-level project estimates and detalize them over time

- Plan the development budget and ensure you have some extra funds in reserve

- Brainstorm the app details and discuss the delivery timeline with your team

- Monitor the project progress closely at the end of every sprint

- Start promoting your product once its barely functional, not once its nearly finished

- Pay utmost attention to publishing your app to app stores correctly

- Promote your products to potential audience via a variety of channels

You might delegate the marketing and promotion activities to professionals, as it will ensure they determine the best marketing approach and promotion channels to align them with your product evolution strategy.

What specialists are needed for MVP development and how to find them quickly

There are several core competencies that must be available in your development team. These include designers, front-end and back-end (or fullstack) developers, automation QA engineers and DevOps engineers, database administrators, Project Manager, etc. Some of these might be already at your fingertips, some might be accessed externally.

There are three main approaches to building software development teams: hiring them as a part of your in-house team or freelancers, enlisting support from your cloud computing provider or hiring an IT outsourcing contractor.

The first approach is the longest and the most risky one. This means you need to spend time sourcing, interviewing an recruiting talents and forming a team out of them. This might seem the safest way, but there is a high risk of talents leaving your team and putting your project at risk.

The second approach, enlisting the technical support from your cloud provider — it is a decent choice to stay on the safe side, as you work with skilled DevOps engineers and other technical talents that will provide top-notch infrastructure and workflows for your product development. However, you will end up with platform-bound infrastructure and vendor lock-in.

FInally, outsourcing some (or most) of the tasks to a trustworthy IT outsourcing provider leads to instant access to all the skill you need, backed up by solid cloud computing expertise and legal protection through NDA and SLA, so you get the best of two previous approaches without getting any downsides.

What project aspects must be done internally and what can be outsourced

This is always an object of heated discussions, as every entrepreneur wants to retain as much control over the business as possible, while saving on the costs due to outsourcing. However, it is always better to delegate the aspects you are not expert in to professionals, and concentrate on what you do best, while outsourcing the rest.

This way you can dedicate your efforts to the core competencies while keeping an eye on such project aspects as product development, infrastructure management and monitoring, database administration, product promotion, etc. Naturally, product presentations, sales, billing, customer support and business negotiations are best done in-house.

What cloud platform to select (checklist)

There are multiple cloud computing platforms that provide the tools and services needed for developing and launching financial apps. However, the things to consider involve the cost-efficiency of scaling, the availability of API packages, the ease of third-party module integration using platform-specific tools, etc.

- Plan for all the features that will eventually be added to your product

- Consult regarding the best technologies to implement these features

- Check what features are available for these technologies with major cloud providers

- Take a look at the platforms for MVP delivery like Google App Engine or AWS CodePipeline

- Learn how these platforms scale to production-ready environments

You can make these choices yourself, ask the cloud provider’s support specialists or listen to your IT outsourcing team advice. For example, IT Svit has helped 100+ startups develop their MVPs and scale successfully using AWS and Google Cloud infrastructure.

How to ensure your app operates securely

There are multiple security layers and mechanisms you can implement to ensure secure operations of your financial apps. Banks and payment gateways require compliance with many regulatory documents, and most of this is ensured through using APIs that are readily available. However, your app should also be secure by design and your infrastructure must utilize various security features like:

- Tokenization and security checks on sign-in

- Microservices instead of monolith apps to reduce exposure area

- Docker container security usage for every system component

- Correct configuration of Kubernetes IAM policies to limit the potential impact

- Using cloud provider’s security features like Google Stackdriver or Amazon CloudWatch

- Using DDoS protection services like Amazon CloudFront or other CDNs.

How to gain traction and promote your financial apps efficiently

You should dedicate a significant effort to promoting your payment apps and bitcoin apps before the release. There are multiple thriving and passionate bitcoin communities that can adopt and back up your bitcoin apps, and partnership with major eCommerce portal can be fruitful to promote your financial and payment apps.

There also are promotion methods like Google Ads campaigns and PPC advertising, as well as various other marketing approaches. These are best discussed with marketing specialist, who will be able to design a unique promotion strategy for your projects.

Conclusions on development of financial apps, bitcoin apps and other payment apps in 2020

To sum it up, there is a huge potential in building various kinds of financial apps in 2020. We have described the approximate process of payment apps development and covered the key moments to look at. The key requirement for doing this successfully lies with finding a reliable technology provider — and IT Svit is ready to lend a hand here! We have ample experience developing cryptocurrency exchanges and various payment apps and we are ready to help turn your next idea into a successful product!