Financial Risk Modeling

-

2597

-

0

-

0

-

0

We’re happy to announce our important skills achievement – risk assessment. This article covers basics with a simple example and unveils some specific terms, like “Value at Risk”, which helps businesses answer common strategic questions, like “How much could I lose if…?” or “What is the worst scenario could be in a super bad month?” in order to prevent potential money losses.

Risk assessment is a part of our fast-growing Data Science service which helps us to solve a specific kind of tasks. Here is a simple example:

Let’s say we need to create a risk model to use it to predict possible future returns based on a given daily price changes in the form of matrix. A cropped version of the full matrix is shown below:

| Daily Price Changes | |||||

|---|---|---|---|---|---|

| -15.625 | -31.25 | -157 | -157456.001 | -12.50 | 0 |

| 0 | 0 | 0 | -2771.5169 | 12.5 | -37.5 |

| 234.375 | 343.75 | 469 | -11716.414 | 37.5 | 125 |

| -343.75 | -531.25 | -843 | 26496.5056 | -12.5 | -125 |

| 46.875 | 125 | 281 | -11382.914 | -12.5 | 0 |

| -265.625 | -406.25 | -563 | -3413.2450 | -37.5 | -112.5 |

To build risk model we use “Value at Risk” (VAR) approach. VAR is a statistical technique to determine risk levels over a specific time frame and ensure that these levels do not exceed some predefined “critical” threshold.

To calculate VAR, there are three approaches:

- Variance-covariance method (or correlation or parametric method). Here, the volatility of each risk factor is extracted from the historical observation period (historical data on investment returns is also required). This method is used when the assumption for normally distributed risk factor returns is acceptable. This is, actually, its main disadvantage.

- Historical simulation method. It avoids pitfalls of the previous method, but some rare events and crashes can be included in the results.

- Monte Carlo simulation method. The most realistic method. It uses empirical distributions of risk factors to generate portfolio values at given time periods (horizons).It also gives the higher flexibility in terms of choosing distributions for returns and bringing in subjective judgments and external data, resulting in more accurate VAR.

Considering all the above, to implement the risk model for this particular case, the Monte Carlo simulation method was used.

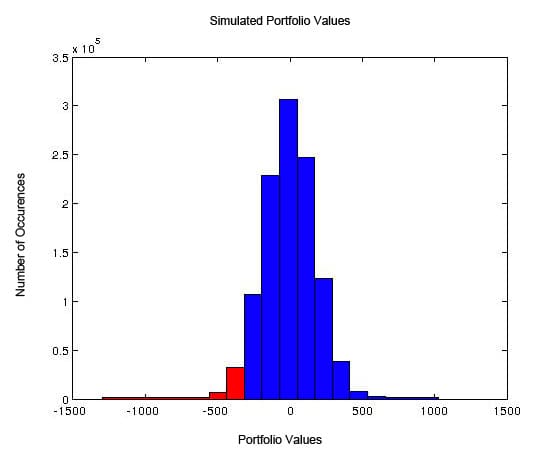

Simulated portfolio values:

Simulated Portfolio Values

This chart shows a threshold of the VAR (red columns) according to the portfolio values matrix.

VaR technique allows you to define a critical threshold, calculate the appropriate “Value At Risk” and take necessary countermeasures in order to mitigate possible negative outcomes.

This dummy example, however, is a perfect demonstration of risk assessment basics. In real world, to meet the most demanding customer requirements, IT Svit specialists can use risk assessment in conjunction with other data mining, machine learning, statistics models and techniques, like Time Series Forecasting methods.